What is the WPS in the UAE? - Comprehensive Guide for HR & Payroll Managers on the Wage Protection System for Fair Payments

13-11-2024

Introduction to the WPS in the UAE

The WPS, or Wage Protection System, is an important part of the labor rules in the UAE. It's here to make sure that employees get their salaries on time and that companies are following the rules. If an employer doesn't pay on time, the WPS helps to find out who is at fault. If you're working in the UAE, it's very important to know what WPS means and how it works to protect you.

So, what is WPS in Dubai? Well, WPS in Dubai is the system the government set up to make sure employees get paid fairly and on time. This means that employers must pay their workers using a special bank system, which records the payments and makes sure everything is being done correctly.

As a WPS UAE system works with banks, it also means you can trust it. If you don’t get paid properly, the WPS system can help find out why. Whether you're working in a big company or a small one, WPS meaning in UAE matters because it helps keep everything fair and clear.

When we talk about WPS full form in salary, we are simply saying that this system is there to protect your salary. You deserve to get your payment on time, and WPS salary meaning ensures that.

For companies, understanding how the WPS system works is really important. If they don’t follow the rules, they might face penalties or fines. TimeChart can help businesses and employees understand the system so that no one misses out on their rights.

WPS meaning is not just something that you hear about in legal meetings—it’s something that affects your paycheck! As a company, using a WPS system helps you avoid mistakes. You can also feel more confident knowing that your employees are being paid on time and in the right way.

Let’s take a simple example: Imagine you're running a small business in Dubai. Every month, your employees are expecting their paychecks. By using the WPS Dubai system, you make sure their wages are sent directly to their bank accounts, with clear records of each payment. No one gets confused, and your employees know that they are being treated fairly. Plus, using the WPS in Dubai system means you don't have to worry about any fines from the government.

For employees, knowing the WPS system means you can hold your employer accountable if there's a delay in your salary. With this system, you are protected, and you can always be sure that you will receive your money on time.

At TimeChart, we believe in making sure that everyone understands the WPS UAE system. We want you to feel confident whether you are an employer or an employee. TimeChart helps businesses stay up to date with all the rules so you can focus on what matters most—your work and your people.

In 2024 and beyond, the UAE continues to improve its labor laws to make things fairer for everyone. So, if you want to keep up with the latest rules, including anything about WPS, TimeChart is here to guide you. Trust us to keep things clear, simple, and fair for you.

What is WPS in UAE? WPS Meaning, Benefits, and How It Works

Have you ever wondered how the salary payments are tracked and protected in the UAE? Well, that's where WPS comes in. WPS stands for Wage Protection System, and it's a helpful tool that guarantees workers in the UAE get paid the right amount, on time, and in the right way.

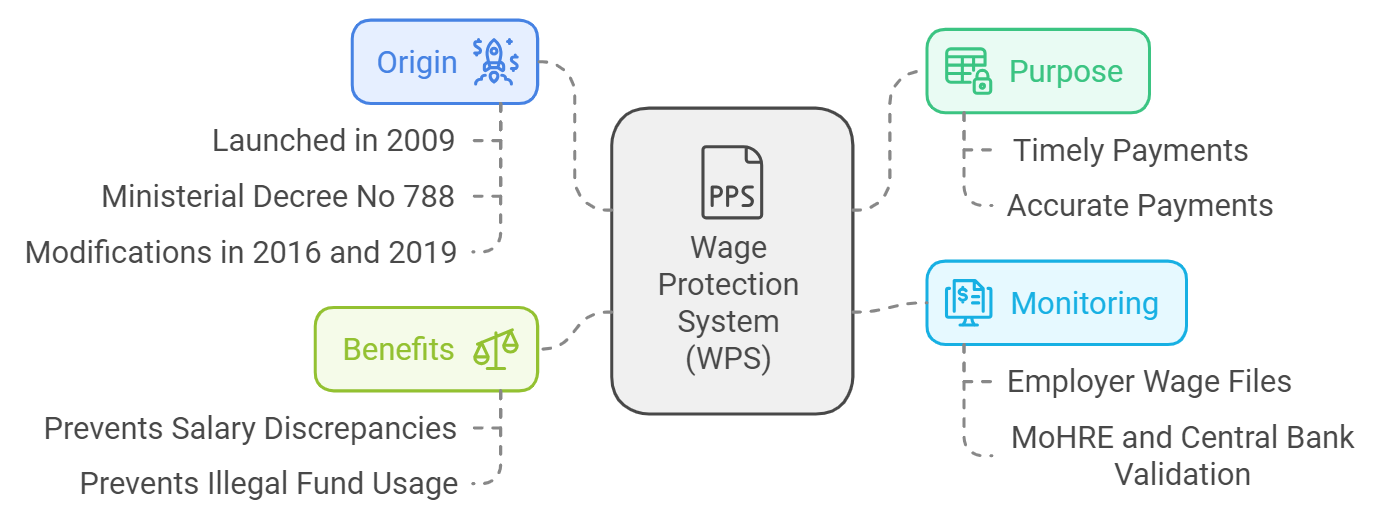

WPS Meaning in simple terms is a system set up by the UAE government to ensure that employers pay their employees according to their contracts. This system started back in 2009 when the Ministry of Human Resources and Emiratisation (MOHRE) and the Central Bank of the UAE worked together to create it. WPS in UAE has helped millions of workers by making sure companies follow the rules and pay their workers fairly.

WPS Full Form in Salary refers to this electronic system that allows workers' wages to be paid electronically through banks. The system works by making sure employers upload salary details to a database, which the government checks. Once everything is verified, the money is transferred to the employees' bank accounts.

This system was created to solve a big problem: some employers used to delay payments, refuse to pay the full salary, or even find ways to avoid paying workers altogether. This caused a lot of stress for employees and often led to arguments or even legal issues. With WPS UAE, all this was put to an end. Now, companies can no longer get away with unfair payment practices, and employees know they will be paid fairly.

WPS System is now mandatory for most businesses in the UAE, including those in the Jebel Ali Free Zone (JAFZA). However, some government-owned companies and other specific free zones are not required to use it. By October 2015, around 3.5 million workers in the UAE were already benefiting from this system, according to the International Labour Organization (ILO). That means most workers in the UAE are now protected by WPS Dubai.

To make things easier, companies upload all their employees’ payment details into the system, and the government checks these details for correctness. If everything is good, the payment is made to the employee. This makes sure employees get their salaries on time, with no delays, and no unfair deductions.

Let’s look at how WPS benefits both employers and employees. For employers, it ensures they stay compliant with the law, avoiding penalties or fines. For employees, it guarantees that they are paid what they’re owed and that the money is transferred directly into their accounts. No more waiting for a paycheck that never arrives!

Example of WPS in Action:

Imagine a small business owner in Dubai, “Ali’s Bakery.” Ali uses the WPS system to pay his workers. Every month, he uploads his employees' salary details into the WPS Dubai system. The system checks everything, and the salaries are transferred directly into the employees' bank accounts. Because of WPS, Ali's employees are happy and trust him, knowing they will be paid on time and correctly every month. This makes Ali’s business run smoothly and keeps his workers motivated.

If you’re wondering about the WPS meaning in UAE or how it works for your salary, don't worry! Whether you’re a worker or an employer, TimeChart can help you keep track of everything easily. With our user-friendly tools, you can monitor your payments, make sure everything is correct, and avoid any mistakes in salary calculations.

Benefits of WPS in UAE

The WPS system in Dubai is a big help for both workers and employers. It makes sure that everyone gets paid on time and in the right amount. This means there are fewer problems between employees and employers because both sides can trust that the payment process is fair and transparent.

For example, let’s say you work at a company, and you’re worried about whether you’re being paid the right amount. With WPS Dubai, you can easily check your payments because everything is recorded in the system. This helps make sure that there are no misunderstandings between you and your boss. So, if you ever have a problem, the WPS UAE records can prove what you were paid.

Also, WPS helps companies save a lot of time and money. Instead of doing everything by hand, the WPS system automates the payroll process. This makes it quicker and easier to pay employees. Employers don’t have to worry about making mistakes or spending a lot of time on payroll tasks. The system does all the work for them!

One example is a small business in Dubai that uses WPS to pay its employees. Before they started using WPS, they had a lot of problems with paying workers late, and sometimes workers didn’t get paid the right amount. But now, with WPS in Dubai, everything is smooth. The business owner gets the payroll done quickly, and employees always know exactly when and how much they will be paid. This builds trust and keeps both sides happy.

Another benefit is that if a worker ever says they were underpaid, WPS UAE can help clear things up. The system keeps a record of all payments, so both employees and employers have proof of what was paid. This helps avoid conflicts and makes sure everyone is treated fairly.

So, whether you’re an employee or an employer, WPS Dubai is a helpful tool that makes sure everyone gets paid the right amount on time, saving time, reducing disputes, and keeping things transparent and fair. TimeChart can help you set up and manage the WPS system with ease, so you never have to worry about payroll again!

How to Register WPS in UAE

If you are an employer in the UAE, it's important to know how to register for WPS (Wages Protection System) because it helps both you and your employees. WPS in Dubai is a system that ensures workers are paid on time, in full, and securely through their bank accounts. It helps create trust between employers and employees, which is very important for a good working relationship. Here’s what you need to know to register for WPS UAE:

1. Get a Corporate Bank Account in the UAE

Before you can register, you need to have a corporate bank account in the UAE. This is where you’ll send payments for your employees. Without this account, you won’t be able to use WPS.

2. Pay Employees on Time

It’s very important to pay your workers on time. According to Ministerial Decree No 788, there is a set deadline for salary payments, and you must stick to it. This makes sure that your employees get their paychecks without any delays. Being punctual is a big part of building trust and keeping your team happy.

3. Pay At Least 70% of Your Employees’ Wages

As an employer, you must pay at least 70% of your employees’ salary through the WPS system. This helps your employees to receive their salaries directly to their bank accounts. Only some situations, like unpaid leave, are exceptions to this rule.

4. Work with a WPS Agent

You’ll need to work with a WPS agent to pay your employees. This agent will help you transfer salaries to your employees’ accounts safely and on time. You’ll need to sign a contract with this agent to make sure everything goes smoothly.

5. Be Ready to Pay Fees

The WPS system comes with some fees for employers. This could include charges for using the system or other related costs. Be sure to budget for this to avoid any surprises. The fees are part of using the service and ensure everything works as it should.

6. Register with MOHRE

To register for WPS Dubai, you need to visit the Ministry of Human Resources and Emiratisation (MOHRE) website. On the website, you can create an account and get your login ID for the WPS portal. Once you're set up, you’ll be ready to pay your employees through WPS in Dubai.

Understanding How the WPS Works

When you’re ready to use the WPS system in Dubai, it’s simple, especially with TimeChart here to guide you. Our goal is to make every step easy and clear so that you can pay your team confidently and stay compliant with UAE labor laws. Here’s how WPS in Dubai works in just four easy steps.

1. Prepare and Submit a Salary Information File (SIF)

The first step in WPS UAE is preparing a SIF, or Salary Information File. This file includes all the important details about your employees, like their basic salary, any deductions, overtime, and bonuses. Think of it as a summary of everything each employee earns.

Every time you pay salaries, you submit this SIF through your WPS agent (often your bank). They will check the file for any errors before it goes into the WPS system. This way, TimeChart ensures your SIF is complete and ready to be processed correctly.

Helpful Tip:

No need to include bonuses or end-of-service benefits in the SIF — those don’t require a SIF when processed separately.

2. WPS Salary Check by MoHRE and Central Bank

After your SIF is submitted, the Ministry of Human Resources and Emiratisation (MoHRE) and the UAE’s Central Bank check it to make sure everything follows WPS UAE rules. They want to see that you’re paying at least 70% of your employees and at least 75% of their agreed salary.

If there’s an issue, they’ll notify you to make corrections. Don’t worry — TimeChart is here to help you avoid these errors so you can avoid any delays or penalties.

3. Payment Order to WPS Agent

Once your SIF passes the MoHRE check, the Central Bank will issue a payment order to your WPS agent. If there were errors, you’ll get an email asking you to update the file, but TimeChart helps you get it right the first time. Errors can lead to fines or payment delays, so we make sure you’re covered.

4. Transfer of Salary to Employee Accounts

Finally, your WPS agent will deposit the funds into your employees’ bank accounts. For added convenience, many banks provide a WPS payroll card for employees, which works like any regular debit card. This allows employees to easily access their pay without any hassle.

By following these four simple steps, the WPS system in the UAE becomes straightforward and easy to handle. With TimeChart, you’ll have the tools you need to make sure payroll is done right every time, giving you peace of mind and helping your business run smoothly.

How Do You Prepare SIFs for WPS in the UAE?

Creating a Salary Information File (SIF) for the WPS system is essential to ensure that your employees get paid accurately and on time. WPS in Dubai and across the UAE follows a specific format, and it's very important to get every detail right. At TimeChart, we understand how much you want this process to go smoothly, so let’s break down each step to help you create an accurate and error-free SIF for the WPS.

Here’s a simple, step-by-step guide to help you feel confident that you're doing it right:

Step 1: Open a New Excel File

Every SIF starts as an Excel document. Open a blank Excel file and get ready to enter your employees’ salary information.

Step 2: Employee Details Record (EDR)

The first part of the SIF is the Employee Details Record (EDR). This is where you enter information for each employee. Every employee will have their own row in the EDR section. Make sure each column is filled accurately to avoid any errors.

Here's what goes in each column:

Column A: Enter "EDR" to mark the start of each employee’s record.

Column B: Enter the 14-digit labor card number for each employee (provided by the MOHRE when you secure a visa for them).

Column C: Add the bank routing code (you can get this from your payroll provider or bank).

Column D: Put in the employee’s bank account number (IBAN).

Column E: Start date of salary (the first day of the month or week they’re being paid for).

Column F: End date of salary (last day of the period they’re being paid for).

Column G: Number of days for which the salary is paid (calculated as end date - start date).

Column H: Basic or fixed salary.

Column I: Variable pay, like overtime or bonuses (if any).

Column J: Number of leave days per year.

Each row represents one employee. After filling out all employees' information, your EDR section is complete.

Step 3: Employee Variable Pay (EVP)

If any employee has variable pay like overtime or bonuses, you’ll need to include this as an Employee Variable Pay (EVP) record. This is entered in Column I within the EDR. Only one EVP record per employee is needed. Make sure the total in this column matches any variable pay entered in the EDR rows.

Step 4: Salary Control Record (SCR)

After the EDR rows, add your company’s details. This is called the Salary Control Record (SCR) and is placed at the end of the SIF.

Here’s what to enter in each column:

Column A: "SCR" to mark this row as the Salary Control Record.

Column B: Your company’s 13-digit Agent ID (you’ll get this from your payroll provider or bank).

Column C: Bank routing code (same as in EDR).

Column D: Date the file was created.

Column E: Time of file creation.

Column F: Payroll month and year.

Column G: Total number of records in the file (number of employees).

Column H: Total salary amount (fixed and variable combined).

Column I: Payment currency, which is AED.

Column J: This is an optional field; you can leave it blank if not needed.

Step 5: Naming Your SIF File

After filling out all required information, save your file with a specific name to meet WPS system guidelines. The name should follow this pattern:

Your 13-digit MOHRE employer ID.

Date in YYMMDD format (e.g., April 9, 2024, would be "240409").

Time in HHMMSS format (e.g., 10:30:23 would be "103023").

Your file name will look like this: 1234567890123_240409_103023.SIF

Tips for Success

1. Double-check all entries to avoid any penalties or delays.

2. Name the file exactly as required by WPS UAE guidelines.

3. Consult with your payroll provider if you need assistance with bank routing codes or other specifics.

At TimeChart, we make sure your payroll runs smoothly, letting you focus on your business. WPS UAE compliance can be easy, and with our support, you can have confidence that your SIF files will be accurate and on time. Let TimeChart simplify your payroll, so you never have to worry about WPS requirements again.

Fines and Penalties for Non-Compliance with UAE WPS

In the UAE, the Wage Protection System (WPS), a system used to ensure that employees are paid on time, is critical for any business. If a company doesn’t follow WPS regulations, it can face serious fines and penalties. Here’s a clear look at what happens if companies don’t comply, especially if wages are delayed.

Payment Delays

When wages aren’t paid on time, the consequences vary depending on the size of the company. Here’s how it works:

For companies with over 50 employees: If a company delays paying wages beyond 15 days, it receives reminders. After 17 days, WPS suspends work permits, and the company may be inspected by the Ministry of Human Resources and Emiratisation (MOHRE). When the delay reaches 30 days, legal actions may begin, and companies with over 500 employees are categorized as “high-risk.” After 60 days, work permits are suspended across all the owner's companies in the UAE.

For smaller companies: Even businesses with fewer than 50 employees will have work permits suspended and might be referred to court if payments are delayed up to 60 days. If delays happen twice in one year, they’re treated the same as larger companies.

Penalties for Providing Incorrect Wage Information

Another common issue is when companies submit incorrect wage information to avoid payments. If caught, companies are fined AED 5,000 per employee, up to AED 50,000, making it risky and expensive to cut corners on wage data.

For example, a small business with 75 employees in Dubai decided to delay salaries beyond 30 days and had its work permits frozen. Once notified, they quickly worked to meet the WPS standards to avoid further fines and court referrals.

WPS Compliance: Key Steps for Business

Using WPS is simple but essential. Here’s how to stay compliant:

Register with MOHRE and open an approved bank account.

Sign an agreement to use WPS through the selected bank.

Submit wage data and transfer instructions to the bank monthly.

Pay wages on the set due date to avoid any compliance issues.

For 2024 and beyond, the UAE is continuing to enforce WPS regulations strictly to support fair wages for workers. By staying compliant, you avoid fines and show your commitment to fair practices.

Other Forms of Non-Compliance with WPS in the UAE

In addition to payment delays, some companies may attempt to evade their wage responsibilities in other ways, leading to serious penalties under the WPS in the UAE.

Providing False Payment Data

When companies knowingly submit incorrect wage information to avoid paying employees, they face a fine of AED 5,000 per affected worker, up to a maximum of AED 50,000 if multiple workers are involved. This penalty is designed to discourage any manipulation of wage records and ensure that all employees are fairly compensated.

Forcing Employees to Sign False Payment Receipts

Some companies may pressure employees to sign fake wage slips to make it appear as though payments have been made. This tactic is also subject to a fine of AED 5,000 per affected worker. Just like providing false wage data, this action incurs a maximum penalty of AED 50,000 if multiple employees are affected.

How to Get the Best Value from Using the WPS System in Dubai and UAE

When using the WPS system in Dubai or UAE, making sure you get the most out of it can make a big difference for your business. With TimeChart as your partner, you don’t just comply with requirements; you get a smart, friendly system that supports every payroll need you have. Here’s a simple guide to get the best value from using WPS in Dubai or the UAE for your business.

1. Choose the Right WPS Agent for Your Business Needs

The first step in making the most of the WPS system is finding the right agent or payroll service provider. This is where TimeChart comes in. With the right agent, you’ll have someone who knows WPS rules and requirements inside out and ensures you’re always up to date. TimeChart checks your Salary Information File (SIF) for any errors and makes sure your payments are always on time. This way, you’re never at risk of penalties or fines from missed payments.

2. Ensure Payments Are Fast, Safe, and Easy

Paying your employees can sometimes feel stressful, especially if you’re busy growing your business. That’s why TimeChart is here to make sure your payroll process is smooth. With TimeChart and the WPS system, you can rest assured that every salary goes out on time, reliably, and safely. This means less stress and more time for you to focus on what matters most: running your business.

3. Support for All Employees, No Matter Their Salary Level

A good WPS agent like TimeChart doesn’t just process payments; it also helps make sure every employee has a way to get paid. With TimeChart, all your workers, no matter what they earn, have an account to receive their salary. This makes things fair and simple for everyone, creating a happy and motivated workforce.

4. Avoid Errors and Save Time

When you have TimeChart handling your WPS needs, you don’t have to worry about complicated processes or paperwork errors. TimeChart’s system reviews everything carefully, catching mistakes that might cause problems. You save time, avoid headaches, and know your business is on track.

5. Keep Your Employees Happy with Reliable Payment

Paying your employees on time doesn’t just keep you in line with WPS rules; it also keeps your team motivated. Reliable payment builds trust, and a happy team is more productive. With TimeChart, payments are always prompt, allowing you to keep your workforce satisfied and focused.

How to Check the WPS Status of a Company in Dubai

If you’re an employee, a future employee, or even a company owner, checking a company’s WPS status can make a big difference. WPS stands for Wage Protection System, and it’s there to make sure employees in the UAE get paid fairly and on time. For companies, it’s very important to follow WPS rules. For employees, knowing a company’s WPS status can help you feel safe, knowing your wages are protected.

Here’s a simple, step-by-step guide on how to check a company's WPS status in Dubai or the UAE.

Step-by-Step Guide to Check WPS Status Online

The Ministry of Human Resources and Emiratisation (MOHRE) has made it easier to check the WPS status online. Here’s how:

Go to the MOHRE Website

Open the official MOHRE website in your browser. The website is available in both Arabic and English, so you can choose the language you prefer.

Find the “Services” Tab

On the homepage, look for the “Services” tab. Hover over this tab, and from the drop-down menu, click on “New Enquiry Services.”

Select “Company Information”

After you click on “New Enquiry Services,” you will be taken to a new page. From here, look for and select “Company Information” in the drop-down options.

Enter the Company Number

You will be asked to enter the company’s registered number. This is a unique number that the company should have, which allows you to view details.

Check the Company’s WPS Status

Once you’ve entered the company number, the system will show the company’s WPS status. This will let you know if the company follows WPS regulations and pays employees as required by law.

If you want more help or have questions, you can reach out to MOHRE in many ways. They offer assistance through email, WhatsApp, phone calls, and online chat.

How to Lift a WPS Ban in UAE: A Step-by-Step Guide

When it comes to managing employee pay in the UAE, using the WPS system is essential. The WPS in Dubai and across the UAE ensures employees get paid on time and keeps your business on the right side of the law. But sometimes, unexpected delays can lead to a WPS ban for a company. If this happens, there are steps you can take to lift the ban and get back on track.

Let’s go over a clear, simple plan to help you avoid a WPS ban and, if it occurs, how to fix it so you can keep your employees and business secure.

1. Avoiding a WPS Ban

The best approach is always to prevent a ban from happening in the first place. Here’s how you can do that:

Use Reliable Payroll Software: Managing payroll digitally helps you follow WPS requirements. A digital payroll system, like the one offered by TimeChart, ensures that all employees get paid on time, reducing the chance of issues.

Keep Cash Flow Stable: Have enough cash ready by payday to cover your employee salaries. This might mean planning ahead, especially if your business has seasonal ups and downs.

Master the Payroll Cycle: Get familiar with how your payroll schedule works, so there are no surprises. Set up reminders and stay on top of each payment cycle.

2. What to Do if Payment is Delayed

Sometimes, delays happen due to reasons you can’t control. Maybe a sudden cash flow problem or a technical issue holds things up. Here’s what you can do if you anticipate a delay:

Notify Employees Early: Let your team know if their salary might be delayed, and assure them that the company is working to resolve it. This way, they stay informed and can trust that the company is stable.

Give Reassurance: Make it clear to employees that this is a temporary issue and the company is committed to fixing it. Good communication can help reduce stress during this time.

3. Steps to Lift a WPS Ban if One Happens

If a WPS ban is placed on your company, don’t worry. You can take specific steps to lift it. Follow these guidelines:

Step 1: Pay All Employees – Ensure every employee, whether they’re in the UAE or abroad, gets the payment they’re owed as soon as possible. This is the first and most crucial step to lifting a WPS ban in Dubai or anywhere in the UAE.

Step 2: Request a Salary Period Adjustment – You’ll need to file a request with services like the ‘Businessmen Services,’ Tawaseel, or through the facilitation system for establishments. This is a way to correct any payroll cycle issues that may have caused the delay.

Step 3: Request Technical Support if Needed – If the ban is still in place, contact (Ministry of Human Resources and Emiratisation) for technical support. Attach proof of payment to show that you’ve met all the salary requirements.

Important Timelines for WPS Ban Situations

Be aware of the timelines set by MOHRE to avoid a ban becoming a bigger issue:

For companies with more than 500 employees, fix any payment issues within 30 days.

For companies with fewer than 500 employees, you have up to 45 days to resolve the payment delay.

After these times, the issue may turn into a legal case. Acting quickly and staying aware of these timelines will help you avoid further complications.

Stay Up-to-Date with WPS Regulations

The rules for the WPS system in UAE are always being updated by MOHRE and the Central Bank. Staying compliant means keeping up with these changes. This is where TimeChart can help by keeping your company’s payroll system in line with the latest regulations. Our digital payroll solution is tailored for UAE businesses, so you can feel confident knowing that your payroll is accurate, on time, and compliant with WPS standards.

FAQS - WPS Dubai and WPS UAE

What is the wage protection system in the UAE?

The WPS system is a way to make sure employees in the UAE get paid on time and correctly. It’s a special program set up by the government to track salaries. Through WPS in Dubai and across the UAE, employers send employee payments to banks, which helps prevent problems like delayed payments or underpayments.

What is the meaning of WPS in salary?

WPS stands for "Wage Protection System." It’s used to make sure employees receive their salaries according to the rules in the UAE. This system helps keep track of payments and ensures that everything is clear and fair.

What is the wage payment system in Dubai?

The WPS system in Dubai is the method used by companies to pay their workers. This system makes sure that salaries are paid through approved banks, so you can be sure that your salary is protected and transferred correctly every month.

What does WPS mean in banking?

In banking, WPS means that your salary will be directly deposited into your bank account. This helps ensure that employees are paid on time, and their salaries are properly tracked.

What is the minimum percentage for WPS?

In the UAE, the minimum percentage for WPS salary is usually 100%. This means your full salary should be paid without any deductions (unless it’s something like taxes or loans that were agreed upon).

What to do if WPS is blocked?

If your WPS in Dubai is blocked, you should talk to your employer and the bank. Sometimes, there could be a problem that needs fixing, like missing paperwork. Your employer should help you solve this issue quickly.

What is the penalty for WPS salary?

If a company doesn’t pay through the WPS system correctly or on time, they could face penalties. The company might have to pay fines, and in some cases, it can affect their business license.

What is the purpose of WPS?

The goal of WPS UAE is to make sure workers are paid fairly and on time. It helps protect employees from delayed or missing salaries, making it a great system to keep everyone happy.

How long does WPS take?

The WPS system usually processes payments quickly, often within a few days. However, it can depend on the bank. If your salary doesn’t show up on time, talk to your employer to check if there are any delays.

Who is excluded from WPS salary?

Some employees might not be part of the WPS system. These include workers who are on certain types of contracts or workers in specific industries that are exempt. Your employer should let you know if you are not included.

What are the new rules for MoHRE in 2024?

The Ministry of Human Resources and Emiratisation (MoHRE) has updated the rules for WPS UAE in 2024. Now, companies need to ensure that all workers are paid through the WPS system on time, with no exceptions. These updates help make the process even more transparent and fair.

What is the basic salary rule in UAE?

In the UAE, your basic salary is the amount agreed upon in your employment contract. This amount is used for calculating WPS payments, and it helps to determine your pay in case you work overtime or take time off.

How do I get my WPS salary?

Your WPS salary will be transferred to your bank account directly. You don’t have to do anything extra to receive it, as long as your employer is following the WPS system.

How does WPS work in UAE?

The WPS system in UAE works by sending your salary through the bank. Once your company registers with the system, your pay is transferred electronically, ensuring that your salary is protected and paid correctly.

What is the WPS system for wages?

The WPS system is a way for companies to pay their workers through banks. It’s used by businesses to keep track of salaries, making sure that employees are paid on time and in full.

What is the last date for WPS in UAE?

The last date for WPS payments in the UAE depends on your employment contract. However, payments are usually expected to be made on time each month, and delays can lead to penalties.

Does WPS cost money?

No, using the WPS system does not cost you anything. The system is free for employees, and it’s provided to make sure that you’re paid correctly and on time.

How to get employer ID for WPS UAE?

Your employer can give you their WPS UAE employer ID. This ID is needed for the system to work. If you need help, ask your HR department for it.

How to check WPS status in UAE?

You can check your WPS status through the bank or the government’s official portal. This will show you if your payments are being processed correctly.

Other Services we Offer in Dubai

Tally PrimeCCTV installation in Dubai

Software development

App development

HRMS software

Tally software for accounting

IT AMC in Dubai

Data centers in Dubai

Access control system

Endpoint security in Dubai

Firewall Security in Dubai

Structured cabling in Dubai

Appsanywhere: Web Based App

Performance Management System

Time Attendance System Software

Smart Visitor Management System

Best Billing Software and Invoicing Software

RECENT BLOG

Employee Performance Management with TimeChart's Monitoring SoftwareThe Importance of Visitor Management Systems in Today's World

Features to Look for in a Help Desk Ticketing Tool

What is Data Loss and Data Loss Prevention (DLP) Solutions

How to Choose the Right Web Designer in Dubai for Your Business

How to Choose Best It Solution Company in Dubai

CCTV camera for homes & offices

Why Network Security is Important for Business Organizations in Dubai

How to Maximize Efficiency with HR Software in Dubai

Why Tally Prime is the Best Accounting Software for Businesses in Dubai