Gratuity Calculator UAE Online Free for End of Services Calculation

Calculate your gratuity in UAE quickly and accurately with our free 2025 updated online gratuity calculator based on UAE labour law. Free Online gratuity calculator for end of services!

UAE Gratuity Calculator Online (Mohre Updated)

Disclaimer

The TimeChart Gratuity Calculator UAE is designed to provide general guidance based on the minimum terms and conditions outlined in the UAE Labour Law by MOHRE. However, the results generated by this tool are not guaranteed to be accurate, complete, neither affiliate with MOHRE or pretend to provide MOHRE services or up-to-date and should not be considered final or legally binding.

Important Notes:

- Consultation Recommended: We strongly advise users to consult with their employer and refer to the official UAE Labour Law for accurate and reliable information.

- Potential Errors: While we strive to provide accurate information, human errors or discrepancies in the calculator’s logic may occur, resulting in incorrect calculations. Users are encouraged to manually verify their gratuity using the official guidelines and consult with relevant authorities.

- No Legal Responsibility: TimeChart is not liable for any inaccuracies, omissions, or errors in the calculator results or for any decisions made based on the information provided.

- Subject to Amendments: Labour laws and related regulations may change over time. The information provided by the calculator may need updates to reflect these changes, which might not always be immediately incorporated.

Guidance Only

This calculator is a tool for general reference and does not replace legal advice or a thorough review of applicable UAE Labour Laws. For specific legal issues or disputes, please consult a qualified legal professional or your employer for tailored advice.

By using this calculator, you acknowledge and agree that TimeChart is not responsible for any actions taken or decisions made based on the results of this tool.

Also check out - Time Chart calculator - Calculate Decimal Hours To Hours & Minutes

Read more about types of Leaves in UAE Labour Law: Annual Leave in UAE

Public Holidays 2025, Weekends, and Leave Types in the UAE: A Comprehensive Guide

Medical & Sick Leave in UAE Labour Law: Guidelines & Requirements 2025

Understanding Unpaid Leave Under UAE Labour Law 2025: A Comprehensive Guide

Top 7 Best Time Attendance System Brands in Dubai

Understanding Gratuity Calculation in the UAE: A Simple Guide

At some point, every employee may move on from their job—whether for retirement, relocation, or exploring new opportunities. When this happens in the UAE, employers are required to provide an end-of-service gratuity payment, as outlined by UAE Labor Law. This gratuity, often referred to as مكافأة, is a financial reward given to employees at the end of their employment, provided they have completed at least one year of continuous service.

The amount of gratuity depends on factors such as the duration of service, the reason for leaving, and the type of employment contract. While the law ensures fairness, understanding how to calculate your gratuity can feel overwhelming.

To make things easier, we've broken it down into simple steps that anyone can follow. Here's what we'll cover:

- Key Terms: Understanding what gratuity means and its importance under UAE Labor Law.

- Eligibility Requirements: Learn the conditions you must meet to qualify for gratuity payments.

- Factors Affecting Gratuity: Discover how service length, salary, and resignation reasons influence the final payout.

For those looking for quick and accurate answers, a gratuity calculator in UAE online is a great tool. It allows employees to instantly calculate their gratuity based on their salary and service duration, ensuring transparency and ease of use. With tools like these, navigating the process of gratuity calculation in UAE becomes simple and stress-free.

What Is Gratuity in the UAE?

Gratuity, also known as end-of-service benefits, is a payment made by employers to employees when their employment ends. It’s a way to show appreciation for the time and effort an employee dedicated to the company. This benefit is an employee’s legal right in the UAE, provided they meet the conditions outlined in the UAE Labor Law.

Gratuity is often calculated based on an employee’s basic monthly salary and the duration of their service. While it is typically paid at retirement, employees leaving a company before retirement may also be entitled to gratuity, depending on the company’s policies and the nature of their employment contract.

How Does the UAE Gratuity Calculator Work?

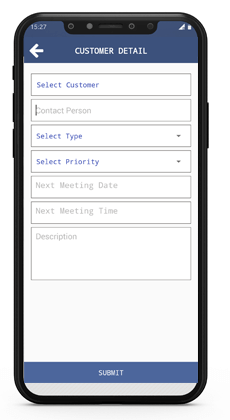

Figuring out gratuity manually can be confusing and may lead to mistakes. Instead, you can use a gratuity calculator in UAE online, which simplifies the process. This tool estimates your gratuity by considering key factors such as:

- Basic salary

- Years of service

- Type of contract (limited or unlimited)

- Reason for leaving the job

With just a few clicks, you can calculate your gratuity and avoid errors. Many online platforms provide free and user-friendly UAE gratuity calculators, making it easier for employees to understand their entitlements.

Who Is Eligible for Gratuity in the UAE?

Not all employees are automatically entitled to gratuity. The UAE labor law specifies certain conditions that must be met for gratuity eligibility:

- Employment Contract: The employee must have a valid labor contract, either limited or unlimited.

- Length of Service: Employees must have worked continuously for at least one year with the same employer to qualify for gratuity.

- Resignation Rules: For employees on unlimited contracts:

- Gratuity may not be paid if they resign without completing the notice period.

- Employees who fail to prove that the employer did not fulfill legal obligations or cannot provide evidence of mistreatment may lose eligibility.

- Dismissal Conditions: If an employee is dismissed under Article 120 of the UAE Labor Law due to misconduct or other violations, they will not be eligible for gratuity.

- Equal Rights for Nationals and Expatriates: Both UAE nationals and expatriates are entitled to gratuity as long as they meet the legal requirements.

Key Points for a Sustainable Gratuity Policy

Gratuity is not just a financial obligation for employers; it’s also a way to promote fairness and loyalty. Companies that adopt environmentally friendly and transparent policies when managing end-of-service benefits can contribute to a more sustainable workplace.

- Use paperless systems for gratuity management to reduce waste.

- Invest in educational programs to help employees understand their gratuity rights.

- Provide easy access to online gratuity calculators for transparency.

Why Is Gratuity Important for Employees?

Gratuity plays a crucial role in providing financial security for employees when they leave a job. Whether you’re planning for retirement or transitioning to a new career, knowing your gratuity calculation in UAE can help you make informed financial decisions.

By using a gratuity calculator in UAE online, employees can easily understand their entitlements and avoid disputes. This transparency builds trust between employers and employees, creating a healthier work environment.

Factors to Consider for Gratuity Calculation in UAE

Calculating gratuity pay in the UAE can feel a little confusing at first, but it becomes much easier when you break it into simple steps. Understanding the key factors that affect your end-of-service benefits is essential. Below, we explain the most important points to help you use a gratuity calculator in UAE online or calculate it manually.

Types of Employment Contracts in the UAE

In the UAE, employment contracts are categorized as limited and unlimited, and these determine how end-of-service benefits are calculated. Although both contracts are designed to safeguard employees' rights, the way gratuity is calculated differs depending on the type of contract. Let’s explore how each contract affects gratuity calculation in the UAE.

-

Limited Contracts

A limited contract is for a fixed duration, agreed upon by both the employer and employee. If the contract is completed successfully, the employee is entitled to gratuity based on the last basic salary. Early termination of a limited contract by the employee may lead to reduced gratuity or penalties.

-

Unlimited Contracts

An unlimited contract offers flexibility and does not specify an end date. Gratuity is calculated based on the time served, but resignation under this type of contract may result in different entitlements compared to termination by the employer.

The Role of Last Basic Salary in Gratuity Calculation

Gratuity in the UAE is calculated based on the last basic salary received by the employee before the end of their employment. It’s important to note that the basic salary excludes additional benefits like housing allowances, overtime pay, or transportation costs. For example:

- If an employee earns AED 12,000 monthly, which includes AED 2,000 as a housing allowance and AED 1,000 for transportation, only AED 9,000 (the basic salary) will be considered for gratuity calculation.

Similarly, deductions like salary sacrifices or unpaid leave are excluded when determining the basic salary. This ensures that the gratuity calculator in UAE online provides fair and transparent results.

Employment Duration and Its Impact on Gratuity

To qualify for gratuity in the UAE, employees must have worked for their employer for at least one continuous year. The calculation is based on the actual time worked and does not include extended unpaid leave, such as sabbaticals or long-term holidays.

- If an employee works for 18 months but takes a 3-month unpaid leave, only 15 months of service will be considered.

- Continuous service is calculated from the employee’s start date to the last working day, as long as no unpaid gaps exist in the timeline.

The Ministry of Human Resources and Emiratisation (MoHRE) has clarified that unpaid breaks are not included when calculating gratuity. This ensures that end-of-service benefits reflect the employee’s actual contribution to the organization.

Using a Gratuity Calculator in UAE Online

To simplify the process of gratuity calculation in the UAE, employees and employers can use an online gratuity calculator. These tools are designed to provide accurate results by factoring in the contract type, last basic salary, and employment duration. A gratuity calculator in UAE online can save time and prevent errors, ensuring that both parties understand their entitlements clearly.

Why Gratuity Calculation Matters

Gratuity is a significant part of an employee’s end-of-service package. It helps employees transition smoothly after leaving a job and acknowledges their loyalty and dedication. Employers also benefit by demonstrating their commitment to fair labor practices, which enhances their reputation and employee satisfaction.

By understanding the factors influencing gratuity calculation in the UAE, employees can ensure their rights are protected, and employers can ensure compliance with local labor laws. Whether you are resigning or your contract is terminated, using tools like online calculators and keeping up with MoHRE guidelines can make the process stress-free and transparent.

What Are the Types of Contracts?

When it comes to understanding gratuity calculation in UAE, knowing the type of employment contract you had with your employer is essential. The UAE Labour Law recognizes two main types of contracts: limited contracts and unlimited contracts. These determine how end-of-service benefits are calculated and the conditions for termination.

Limited Contracts

A limited contract, also known as a fixed-term contract, is designed for a specific duration. It is often used for roles tied to a particular project or a set timeline. The contract clearly states the start and end dates of the employment period.

When the contract reaches its end date, it automatically expires unless both parties agree to renew it. For example, someone hired to complete a construction project would end their employment once the project is finished.

Key Points About Limited Contracts:

- Employees are expected to stay with the company until the contract expires.

- If you resign before the agreed term, you might face penalties such as a labor ban, loss of end-of-service benefits, or the need to compensate the employer.

- Gratuity is calculated based on the completed duration of service within the contract’s timeframe.

- This type of contract provides clarity but less flexibility compared to unlimited contracts.

Unlimited Contracts

An unlimited contract is open-ended and more flexible, without a specific end date. This contract type is commonly used in the UAE, particularly for long-term or permanent employment. Either the employer or the employee can terminate it with proper notice.

The required notice period is usually between one and three months, during which both parties must fulfill their obligations.

Key Points About Unlimited Contracts:

- There is no fixed end date for the employment.

- A notice period of 1-3 months is mandatory for termination from either side.

- Gratuity calculation depends on the total years of service completed.

How Does Contract Type Impact Gratuity?

Understanding the contract type is crucial for using a gratuity calculator in UAE online. For both contract types, gratuity is calculated based on the length of service, but the rules differ slightly:

- For limited contracts, the gratuity is strictly tied to completing the agreed period. Early resignation may result in losing end-of-service benefits.

- For unlimited contracts, gratuity is calculated based on the actual time worked, even if the contract is terminated early, provided legal notice is given.

Knowing your contract type ensures you can accurately determine your end-of-services benefits.

This clear distinction between limited and unlimited contracts highlights the importance of reviewing your employment agreement. It also helps you better plan your career decisions and understand your financial entitlements in the UAE.

Gratuity Pay Calculation for Limited Contracts

When it comes to gratuity pay, employees under limited contracts in the UAE will have their gratuity calculation based on different factors such as their length of service and whether they resigned or were terminated. Gratuity is calculated in tiers, and these tiers differ depending on the circumstances of employment termination.

If the Employee is Terminated

For employees who are terminated from a limited contract, the gratuity calculation depends on the length of service:

- 1-5 years of service: Employees will receive 21 days of basic salary for each year of service.

- More than 5 years of service: Employees are entitled to 21 days of basic salary for the first five years and an additional 30 days of basic salary for every year beyond the five-year mark.

If the Employee Resigns

Gratuity pay will not be granted if the employee resigns before completing one year of service. For employees who have completed more than one year, the following applies:

- Less than 5 years of service: Employees are entitled to 21 days of basic salary for each year of service.

- 5 or more years of service: Employees are entitled to 21 days of salary for the first five years and 30 days for every year after.

Gratuity Calculation Example

Let’s look at an example of calculating gratuity pay for an employee under a limited contract:

- Assumed basic salary: AED 15,000

- Years of service: 4 years

- Calculate the daily wage: AED 15,000 ÷ 30 = AED 500.

- Multiply by 21 (days): AED 500 × 21 = AED 10,500.

- Multiply by the years of service: AED 10,500 × 4 = AED 42,000.

In this example, the total gratuity pay for an employee with 4 years of service will amount to AED 42,000.

Gratuity Pay Calculation for Unlimited Contracts

The gratuity calculation for employees on unlimited contracts differs from that of limited contracts. It varies depending on the type of termination, whether it is due to resignation or termination by the employer.

If the Employee Resigns

- Less than 1 year: No gratuity is granted.

- 1-3 years of service: Employees will receive 1/3rd of their gratuity (21 days' salary for each year of service).

- 3-5 years of service: Employees will receive 2/3rd of their gratuity.

- More than 5 years of service: Employees are entitled to the full gratuity of 21 days' salary for each year of service.

If the Employee is Terminated

- Less than 1 year: No gratuity is provided.

- 1-5 years of service: Employees will receive 21 days of basic salary for each year served.

- More than 5 years of service: Employees are entitled to 30 days of basic salary for each year beyond the first five years.

Gratuity Calculation for Unlimited Contracts Example

Consider an employee with the following details:

- Basic salary: AED 18,000

- Years of service: 6 years

- Calculate the daily wage: AED 18,000 ÷ 30 = AED 600.

- Gratuity for the first 5 years: AED 600 × 21 = AED 12,600 per year. Multiply by 5 years: AED 12,600 × 5 = AED 63,000.

- Gratuity for the additional year: AED 600 × 30 = AED 18,000.

- Total gratuity: AED 63,000 + AED 18,000 = AED 81,000.

This employee would be entitled to AED 81,000 as gratuity pay at the end of their service.

Key Points to Remember for Gratuity Calculation in UAE

- Employees who have served for less than one year are not entitled to any gratuity pay.

- Employees with 1-5 years of service are entitled to 21 days of salary per year of service.

- Employees with more than 5 years of service are entitled to 21 days of salary for the first 5 years and 30 days for every additional year.

- The total gratuity will not exceed the equivalent of two years' wages.

For more convenient and quick calculations, you can use an online gratuity calculator.

Steps to Calculate Gratuity for Unlimited Contracts

When calculating gratuity for employees on unlimited contracts in the UAE, the process is similar to fixed-term contracts. However, there are some key details to keep in mind. For example, let’s say your basic salary is AED 18,000, and you worked for the company for 5 years. Here’s how you can easily calculate your gratuity payout using the following steps:

- Calculate Your Daily Wage

Start by calculating your daily wage based on your basic salary. To do this, divide your basic salary by 30 (the number of days in a month).

AED 18,000 ÷ 30 = AED 600 per day - Multiply by 21 Days

Since you worked for less than 5 years, the gratuity calculation is based on 21 days of basic salary for each year of service.

600 × 21 = AED 12,600 - Apply ⅔ of the Result

Since you worked for more than 3 years but less than 5 years, you’re entitled to ⅔ of the amount.

⅔ of 12,600 = AED 8,400 - Multiply by the Number of Years Worked

Multiply the result by the number of years you worked in the company (5 years in this case).

8,400 × 5 = AED 42,000

So, the total gratuity payable at the end of 5 years of service under an unlimited contract would be AED 42,000.

How to Calculate Gratuity When an Employee Resigns

The gratuity calculation for an unlimited contract differs slightly if the employee resigns, depending on the number of years worked. For employees who resign, the gratuity payout may be reduced, and they are entitled to either ⅓ or ⅔ of the full gratuity based on their years of service.

Example 1: Resignation After 2 Years

If your basic salary is AED 20,000 and you resigned after 2 years, the formula would be:

For service between 1 to 3 years: (1/3 × 21 days × basic salary × years worked) ÷ 30

(7 × 20,000 × 2) ÷ 30 = AED 8,800

So, if you resign after 2 years, you would be entitled to AED 8,800 in gratuity.

Example 2: Resignation After 4 Years

If your basic salary is AED 22,000 and you resigned after 4 years, you can use the following formula for gratuity calculation:

For service between 1 to 5 years: (⅔ × 21 days × basic salary × years worked) ÷ 30

(14 × 22,000 × 4) ÷ 30 = AED 41,466.66

So, for 4 years of service, you would receive AED 41,466.66 as gratuity if you resigned.

Can Gratuity Be Denied?

Under Article 139 of the UAE Labour Law, there are specific situations where gratuity may not be awarded. Here are some common reasons why gratuity can be denied:

- Resigning Without Proper Notice: If an employee resigns without providing the required notice period (except under special circumstances), they may not be entitled to gratuity.

- Termination for Certain Reasons: Employees terminated for specific reasons outlined by the law (e.g., misconduct or criminal activity) may not receive gratuity.

- Resigning to Avoid Dismissal: If an employee resigns to avoid being dismissed, they may not be eligible for gratuity.

It’s important to note that these situations are defined in the UAE Labour Law, and employees should ensure they understand the rules to avoid missing out on their gratuity.

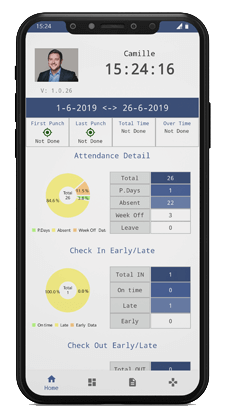

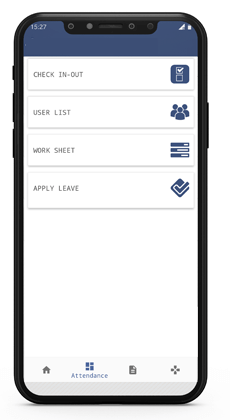

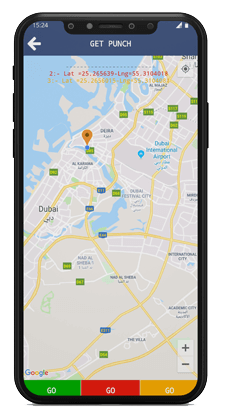

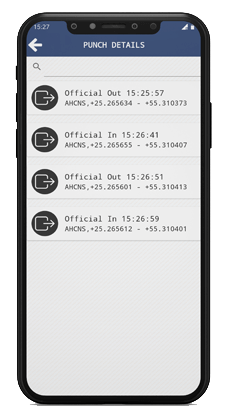

Time Chart: The Ultimate Work Time Tracking and Attendance Solution

TimeChart offers a powerful and easy-to-use platform designed to streamline employee time tracking, attendance management, and task scheduling. With real-time tracking and advanced features, it ensures precision in payroll and simplifies workforce management.

Why Choose TimeChart for Your Business?

- Real-Time Work Time Tracking: Monitor employee working hours in real-time to ensure accurate and efficient time management.

- All-in-One Attendance App: TimeChart is compatible with all devices, making it accessible on desktops, tablets, and smartphones. Whether in the office or on-site, attendance tracking is just a click away.

- GPS Tracking for On-Site Employees: For remote or on-site staff, the built-in GPS tracking ensures location verification, improving transparency and accountability.

- Accurate Payroll and Overtime Calculation: Say goodbye to manual payroll errors! TimeChart automatically calculates employee working hours, including overtime, for precise payouts.

- Shift Scheduling Made Easy: Plan, assign, and manage employee shifts effortlessly with TimeChart’s intuitive scheduling tools.

- Task Management for Better Productivity: Organize and assign tasks efficiently to ensure that all team members know their responsibilities and deadlines.

- Simplified Leave Applications: Employees can apply for leave through the app, while managers can approve or deny requests instantly, streamlining the process.

Download TimeChart on All Devices

Whether you're using Android, iOS, or desktop devices, TimeChart is compatible and user-friendly. Experience seamless time and attendance management on any platform.

Contact Us Today

Ready to enhance your workplace efficiency with TimeChart? Visit our website at TimeChart.org or get in touch to learn more about how we can transform your business operations.

Empower your team with TimeChart—the smart solution for time tracking and workforce management!

Contact us on WhatsApp:

Click here to chat with us.

FAQs

- How is gratuity calculated in the UAE?

In the UAE, gratuity is calculated based on how long an employee has worked. Employees who have worked for 1-3 years are entitled to 21 days' salary for each year of service. For those who have worked for more than 3 years but less than 5 years, they are entitled to two-thirds of their basic salary as gratuity. If someone has worked for more than 5 years, the gratuity calculation is based on 30 days of salary for each year. For example, if your salary is AED 5,000 per month, you can calculate gratuity as follows: - Is gratuity in the UAE calculated on the basic salary?

Yes, in the UAE, gratuity is calculated based on the basic salary, not including allowances like housing, transport, or food. So, if your monthly salary is AED 5,000, and your employer doesn’t pay extra allowances, the gratuity will be calculated based on this AED 5,000. - What is the new gratuity law in the UAE for 2025?

The new law in 2025 has clarified how gratuity should be calculated. Employees are still entitled to 21 days of salary per year of service for the first five years. After that, for every year worked beyond five years, employees are entitled to 30 days of salary per year. Additionally, there is no longer a difference in gratuity calculation if an employee resigns or is terminated. This makes the process simpler and more transparent. - Is gratuity added to the monthly salary?

No, gratuity is not added to your regular monthly salary. Gratuity is a separate benefit paid to employees at the end of their service, either upon resignation or termination. It is not part of the regular monthly income. - When should someone not be paid gratuity?

Employees may not be entitled to gratuity if they leave before completing a full year of service. Also, if an employee is involved in illegal activities like theft or violence, or if the employee has an outstanding debt to the employer, gratuity might be withheld or reduced. - Who is eligible for gratuity in the UAE?

Gratuity is available to expatriate employees working in the UAE. UAE nationals are not eligible for gratuity because they are entitled to a national pension plan, which expatriates do not receive. - When does an employee become eligible for gratuity in the UAE?

Employees are eligible for gratuity once they complete at least one year of service. If an employee leaves before the one-year mark, they are not entitled to gratuity. However, if they complete a full year of service, they will receive gratuity at the end of their tenure, whether it’s through termination or resignation. - Is there any limit for gratuity payable?

Gratuity is calculated based on the employee’s last basic salary (excluding any allowances). However, the total gratuity amount cannot exceed the equivalent of two years' salary. So, even if the calculations result in a higher amount, the maximum gratuity you can receive is capped at two years' worth of basic salary. - What is the criterion for calculating gratuity accrued in the UAE?

Gratuity accrues at the following rates:- For the first 5 years of service: 21 days of salary for each year.

- For more than 5 years of service: 30 days of salary for each year worked after the first five years.

- What are the conditions under which an employer can deny gratuity payment to an employee?

An employer can deny gratuity under the following conditions:- The employee is involved in unlawful activities like misbehavior or violence.

- The employee does not have a legal contract or proof of employment.

- The employee leaves before completing at least one year of service.

By understanding these points, employees can ensure they are aware of their rights regarding gratuity calculation in UAE and use tools like gratuity calculator in UAE onlinefor accurate, quick calculations at the end of their service.

Disclaimer

The information provided in this content is for general informational purposes only. While we strive to ensure the accuracy of the details, there may be inaccuracies or updates that are not reflected here. We strongly advise checking the official UAE government website, your employer, or other authoritative sources for the most up-to-date and accurate information regarding gratuity calculation and end-of-service benefits in the UAE. The rules and regulations may change over time, and we do not take any responsibility for any discrepancies or misinterpretations of this content. Please verify the details with official sources before making any decisions.