UAE VAT Calculator Online Free – Accurate VAT Calculation in UAE

Our UAE VAT Calculator Online Free is designed to help businesses and individuals quickly and accurately calculate VAT in the UAE. Whether you need to add VAT to a price or subtract VAT from a total, this tool ensures precise results based on UAE’s 5% VAT rate.

With a user-friendly interface, real-time calculations, and a clear breakdown of net amount, VAT amount, and total price, our VAT calculator simplifies tax calculations for everyone. Use our online UAE VAT calculator to ensure compliance with UAE tax laws and avoid miscalculations in your transactions.

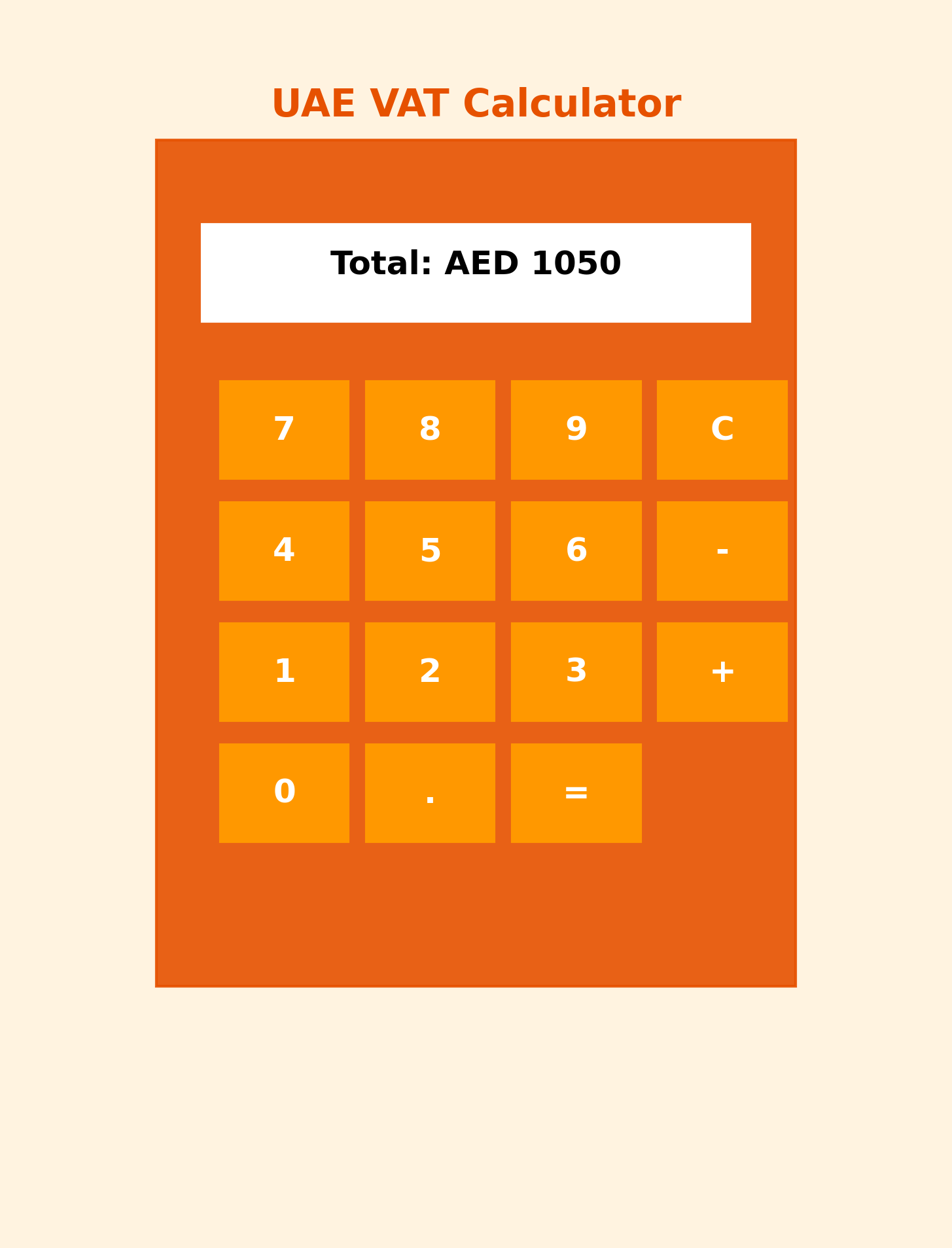

Online UAE VAT Calculator Free

How to Use TimeChart UAE VAT Calculator Online for Free – Step by Step

Our UAE VAT Calculator Online Free is designed to help businesses and individuals quickly and accurately calculate VAT in the UAE. Whether you need to add VAT or subtract VAT, this tool ensures precision based on the UAE’s 5% VAT rate. Follow the steps below to calculate VAT easily.

Step 1: Enter the Amount

In the input box, enter the amount you want to calculate VAT for.

You can input the price with or without VAT, depending on your needs.

Step 2: Select VAT Calculation Mode

Our UAE VAT Calculator Online Free offers two calculation modes:

- Add VAT: Calculates VAT and provides the total amount including VAT.

- Subtract VAT: Extracts VAT from the total amount to show the net price before tax.

Step 3: Choose the VAT Percentage

The default VAT rate is 5%, as per UAE tax laws.

If needed, you can enter a custom VAT percentage for other tax calculations.

Step 4: Click ‘Calculate’

Once you have entered the details, click the ‘Calculate’ button.

The VAT amount, total price, and net price will be displayed instantly.

Step 5: Review the Breakdown

The TimeChart UAE VAT Calculator provides a detailed breakdown, including:

- Entered Amount (with or without VAT)

- VAT Amount

- Total Price (Including VAT)

- Net Price (Excluding VAT)

This online UAE VAT calculator ensures that businesses and individuals comply with UAE VAT regulations while making accurate tax calculations.

Disclaimer

The UAE VAT Calculator and the information provided on this page have been designed to offer general guidance on VAT calculations in the UAE.

While we have taken every effort to ensure accuracy, human errors may occur, and the results generated by this calculator should not be solely relied upon for tax filing or legal compliance.

TimeChart does not take any responsibility for any damage, threat, or loss that may arise from using this calculator or the content provided. Furthermore, TimeChart will not be held responsible for any legal actions resulting from reliance on this tool.

For accurate tax information and compliance, users should only trust information from government authorities, official sources, and tax consultants. It is strongly recommended to seek professional advice from a certified tax expert or consult the Federal Tax Authority (FTA) and other official UAE government sources for legal and tax-related matters.

This calculator is intended only for general informational purposes and should not be used for legal tax filing. Before making any tax-related decisions, please consult a licensed tax professional to ensure compliance with UAE VAT laws.

Example of UAE VAT Calculation

To better understand how our UAE VAT Calculator Online Free works, let's look at a few examples of VAT calculations based on the 5% VAT rate in the UAE.

Example 1: Adding VAT to a Price

Scenario: You have a product priced at AED 1,000 (excluding VAT), and you need to calculate the total price including VAT.

- Entered Amount (Excluding VAT): AED 1,000

- VAT Amount (5% of 1,000): AED 50

- Total Price (Including VAT): AED 1,050

💡 Formula: Price + (Price × VAT Rate) = Total Price

1,000 + (1,000 × 5/100) = 1,050 AED

Example 2: Removing VAT from a Total Price

Scenario: You receive a bill of AED 1,050 (including VAT), and you want to find the original price before VAT was applied.

- Total Amount (Including VAT): AED 1,050

- VAT Amount (5% of Net Price): AED 50

- Net Price (Excluding VAT): AED 1,000

💡 Formula: Total Price ÷ (1 + VAT Rate) = Net Price

1,050 ÷ 1.05 = 1,000 AED

Example 3: Custom VAT Calculation

If you need to apply a different VAT percentage (e.g., 7%), you can enter the custom VAT rate in our UAE VAT Calculator to get an accurate breakdown.

This online UAE VAT calculator ensures fast and error-free VAT calculations for businesses and individuals across the UAE.

VAT in UAE

Value Added Tax (VAT) in the UAE is an indirect tax applied to the supply of most goods and services. The UAE introduced VAT on January 1, 2018, at a standard rate of 5%. VAT is collected at each stage of the supply chain, and businesses act as intermediaries to collect and remit it to the government.

VAT was introduced to reduce reliance on oil revenue and create a sustainable economic model. Businesses must comply with VAT regulations set by the Federal Tax Authority (FTA) to ensure proper tax collection and reporting.

Who Needs to Pay VAT in the UAE?

VAT applies to businesses and consumers alike. However, businesses are responsible for collecting VAT and remitting it to the FTA.

1. VAT for Businesses

Businesses are required to register for VAT if they meet the following criteria:

- Mandatory VAT Registration: Businesses with annual taxable supplies exceeding AED 375,000 must register for VAT.

- Voluntary VAT Registration: Businesses with annual taxable supplies between AED 187,500 and AED 375,000 can choose to register voluntarily.

- VAT Collection: Registered businesses must charge 5% VAT on taxable goods and services.

📌 Example: If a business sells a product worth AED 2,000, the VAT charged would be:

2,000 × 5% = AED 100

Total price for the customer = AED 2,100

2. VAT for Consumers

VAT is included in the final price of most goods and services.

Consumers pay VAT when they purchase products or services, but they do not need to file VAT returns.

VAT-Exempt and Zero-Rated Sectors in the UAE

While most goods and services are subject to 5% VAT, some are zero-rated (0%), and others are VAT-exempt.

1. Zero-Rated Goods and Services (0% VAT)

These sectors are subject to VAT, but the applicable rate is 0%, meaning businesses do not charge VAT on sales but can still recover VAT on expenses.

- Healthcare services (including hospitals and medical professionals)

- Education services (including schools, universities, and training centers)

- Exports of goods and services outside the GCC

- Certain residential properties (first sale of new homes)

📌 Example: If a school charges AED 10,000 per term, the VAT would be:

10,000 × 0% = AED 0 (No VAT charged)

2. VAT-Exempt Goods and Services

Some industries are completely exempt from VAT, meaning businesses do not charge VAT and cannot recover VAT on related expenses.

- Financial services (e.g., bank loans, insurance policies)

- Local passenger transport (e.g., buses, taxis, metro)

- Sale of bare land

- Residential properties after the first sale

📌 Example: A passenger taking a taxi ride for AED 50 will not be charged VAT.

How is VAT Calculated in the UAE?

VAT is calculated at 5% of the taxable amount. Businesses can use two methods for VAT calculations:

1. Adding VAT to a Price (Exclusive VAT Calculation)

If a product or service price does not include VAT, you need to add VAT to get the final price.

💡 Formula:

📌 Total Price = Net Price + (Net Price × VAT Rate)

Example: If a product costs AED 1,000 (excluding VAT):

📌 1,000 + (1,000 × 5/100) = 1,050 AED

📌 The VAT amount is AED 50, and the final price is AED 1,050.

2. Removing VAT from a Price (Inclusive VAT Calculation)

If a price already includes VAT, you can extract the VAT amount and determine the base price.

💡 Formula:

📌 Net Price = Total Price ÷ (1 + VAT Rate)

Example: If a bill total is AED 1,050 (including VAT):

📌 1,050 ÷ 1.05 = 1,000 AED

📌 The VAT amount is AED 50, and the net price is AED 1,000.

How to File VAT Returns in the UAE?

Businesses registered for VAT must file VAT returns every quarter through the FTA online portal. The return includes:

- Total sales and purchases for the tax period.

- Total VAT collected from customers.

- Total VAT paid on business expenses.

- Net VAT payable or refundable.

📌 Deadline: VAT returns must be submitted within 28 days after the tax period ends. Late filings may result in penalties.

Also Do Visit Our Free Tools

Leave Salary Calculator UAE Gratuity Calculator UAE Overtime Calculation in UAETime Chart - Decimal to Hours and Minutes Calculator

Time Chart - Online Mileage & Fuel Cost calculator

Time Chart Free Work Hour Calculator & Time Card

Time Chart - Convert Military Time

Time Chart - Online Free Timer Clock

Time Chart - Online Pomodoro Timer

Also check out - Time Chart calculator - Calculate Decimal Hours To Hours & Minutes

Read more about types of Leaves in UAE Labour Law: Annual Leave in UAE

Public Holidays 2025, Weekends, and Leave Types in the UAE: A Comprehensive Guide

Medical & Sick Leave in UAE Labour Law: Guidelines & Requirements 2025

Understanding Unpaid Leave Under UAE Labour Law 2025: A Comprehensive Guide

VAT Registration Criteria

Who Needs to Register for VAT in the UAE?

Value Added Tax (VAT) in the UAE is a legal requirement for businesses that meet specific criteria set by the Federal Tax Authority (FTA). Businesses and individuals engaged in commercial activities must determine whether they need to register for VAT based on their annual taxable turnover.

Mandatory VAT Registration

A business must register for UAE VAT if its annual taxable turnover exceeds AED 375,000. This threshold applies to all taxable supplies, including goods and services subject to standard 5% VAT and zero-rated supplies.

Businesses That Must Register for VAT:

- Companies involved in the sale of goods and services that exceed AED 375,000 in annual revenue.

- Businesses that import goods into the UAE where VAT applies.

- Companies that export goods and services but want to recover VAT paid on expenses.

- Businesses providing services subject to VAT, such as real estate, consulting, professional services, and technology solutions.

- E-commerce businesses selling to UAE consumers.

- Freelancers and independent professionals earning more than AED 375,000 per year.

Failure to register for VAT when the business meets the mandatory threshold can result in penalties and fines from the FTA.

Voluntary VAT Registration

A business can choose to register for VAT voluntarily if its annual taxable turnover is between AED 187,500 and AED 375,000. This allows businesses to reclaim VAT on purchases, even if their revenue has not yet reached the mandatory threshold.

Who Can Voluntarily Register?

- Small and medium-sized enterprises (SMEs) planning for future growth.

- Startups expecting to reach the mandatory VAT threshold soon.

- Businesses that want to claim VAT refunds on expenses.

- Suppliers and service providers who deal with VAT-registered companies.

Voluntary registration benefits businesses by allowing input VAT recovery and making them more credible to VAT-registered clients and suppliers.

Exemption from VAT Registration

Some businesses and industries are exempt from VAT registration and are not required to charge or collect VAT. However, these businesses cannot claim VAT refunds on their expenses.

Businesses That Are Exempt from VAT:

- Companies that only provide VAT-exempt services such as financial services, life insurance, and residential real estate leases.

- Businesses with annual taxable turnover below AED 187,500 that choose not to register voluntarily.

- Local transportation services, including taxis, buses, and metro services.

Even if a business is VAT-exempt, it may still need to track VAT expenses to ensure compliance with UAE tax regulations.

VAT Registration Process in the UAE

Businesses that meet the registration criteria must apply for VAT registration through the Federal Tax Authority (FTA) portal. The process involves the following steps:

Step 1: Prepare the Required Documents

To register for UAE VAT, businesses must provide:

- Trade license copy

- Passport copy and Emirates ID of the business owner

- Business bank account details

- Financial records showing taxable revenue

- Customs registration details (if applicable)

Step 2: Online Registration Through the FTA Portal

Businesses must visit the FTA website and create an account. They must fill out the VAT registration form, providing details about their business activities, revenue, and expected taxable supplies.

Step 3: VAT Registration Approval and TRN Issuance

Once the application is reviewed and approved, the FTA issues a Tax Registration Number (TRN). The TRN is a unique identifier that businesses must include on all invoices and official documents.

Step 4: Start Charging and Collecting VAT

After receiving the TRN, businesses must:

- Charge 5% VAT on taxable goods and services.

- Issue VAT-compliant invoices with the TRN number and VAT breakdown.

- Maintain accurate financial records for at least five years.

- File VAT returns quarterly through the FTA portal.

VAT Deregistration

A business must apply for VAT deregistration if:

- It stops operating or ceases taxable activities.

- Its taxable turnover falls below AED 187,500 for 12 consecutive months.

- It switches to VAT-exempt activities.

Deregistration is done through the FTA online portal, and businesses must settle any outstanding VAT liabilities before approval.

What Are the Benefits of VAT Calculation in UAE and Using a Calculator for VAT Calculation?

Accurate VAT calculation in UAE is essential for businesses to comply with UAE tax laws and avoid penalties from the Federal Tax Authority (FTA). Whether a business is required to collect 5% VAT or needs to determine the VAT-inclusive and VAT-exclusive amounts, using an online UAE VAT calculator simplifies the process.

Benefits of VAT Calculation in UAE

- Ensures Compliance with UAE Tax Laws

Businesses operating in the UAE must follow the VAT regulations set by the FTA. Miscalculations in VAT can lead to financial penalties and legal issues. By calculating VAT accurately, businesses:

- Avoid incorrect VAT reporting.

- Ensure they charge the correct 5% VAT on taxable goods and services.

- Prevent non-compliance penalties imposed by the FTA.

- Helps Businesses Understand VAT Liabilities

For VAT-registered businesses, understanding how much VAT needs to be paid or reclaimed is essential. Calculating VAT properly allows businesses to:

- Determine the VAT amount collected from customers.

- Calculate the input VAT paid on business expenses.

- Identify the net VAT payable or refundable in the FTA VAT return filing.

- Simplifies Financial Management

Proper VAT calculation in UAE helps businesses manage their finances effectively. It allows for:

- Better budgeting and cash flow management.

- Accurate profit and loss assessment.

- Avoidance of unnecessary VAT overpayments or underpayments.

- Reduces Errors in VAT Filing

Businesses must file VAT returns with the FTA every quarter. Incorrect VAT calculations can result in:

- Filing incorrect VAT returns, leading to FTA penalties.

- Inaccurate tax payments, affecting business financial stability.

- Delays in VAT refund claims due to calculation mistakes.

Using a UAE VAT calculator ensures accuracy and eliminates errors in VAT return filings.

- Provides Transparency in Business Transactions

For businesses dealing with clients, suppliers, and partners, correct VAT calculation ensures transparent invoicing. A VAT-compliant invoice must include:

- The Tax Registration Number (TRN).

- The net price (before VAT).

- The VAT amount (5%).

- The total amount (including VAT).

Clear VAT calculations help in building trust with customers and ensuring compliance with tax laws.

Benefits of Using an Online UAE VAT Calculator

- Saves Time and Effort

Manually calculating VAT for every transaction can be time-consuming and prone to errors. A UAE VAT calculator automates the process by:

- Instantly calculating the VAT-inclusive and VAT-exclusive prices.

- Providing accurate results in real time.

- Reducing the need for manual tax calculations.

- Provides Instant and Accurate Results

An online VAT calculator eliminates errors by ensuring accurate VAT calculations. It:

- Allows users to add or remove VAT from a given amount.

- Supports custom VAT rates (for special VAT cases).

- Ensures businesses apply the correct tax rate on their transactions.

- Helps Businesses File VAT Returns Correctly

For FTA VAT return filing, businesses must submit precise VAT calculations. A UAE VAT calculator provides:

- A detailed breakdown of VAT amounts.

- Clear separation of VAT-inclusive and VAT-exclusive figures.

- Data that helps businesses prepare accurate VAT returns.

- Useful for Individuals and Businesses

Whether you are:

- A business owner charging VAT to customers.

- A freelancer calculating VAT on invoices.

- A consumer checking the VAT amount on purchases.

A UAE VAT calculator helps in all cases by providing instant and precise VAT values.

- Mobile-Friendly and Easy to Use

An online VAT calculator is accessible from any device. It is:

- Designed for desktop and mobile users.

- User-friendly, requiring no manual formulas.

- Quick and efficient for real-time VAT calculations.

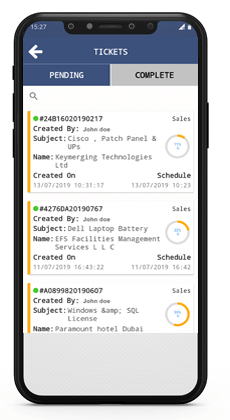

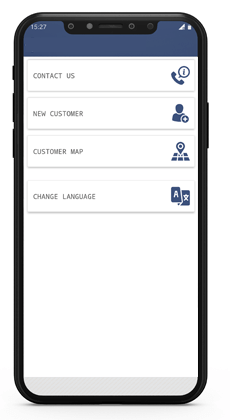

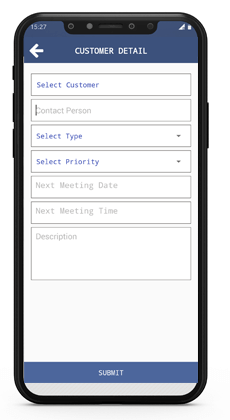

Time Chart: The Ultimate Work Time Tracking and Attendance Solution

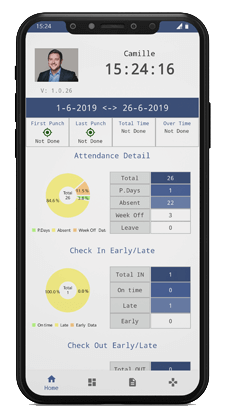

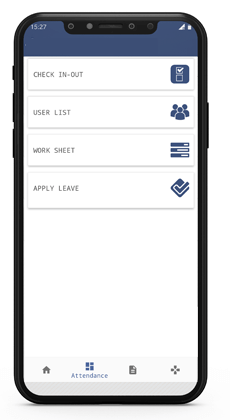

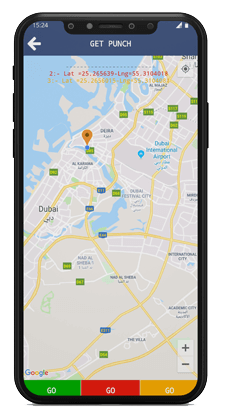

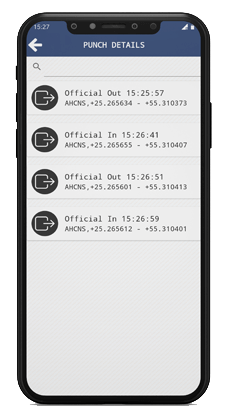

TimeChart offers a powerful and easy-to-use platform designed to streamline employee time tracking, attendance management, and task scheduling. With real-time tracking and advanced features, it ensures precision in payroll and simplifies workforce management.

Why Choose TimeChart for Your Business?

- Real-Time Work Time Tracking: Monitor employee working hours in real-time to ensure accurate and efficient time management.

- All-in-One Attendance App: TimeChart is compatible with all devices, making it accessible on desktops, tablets, and smartphones. Whether in the office or on-site, attendance tracking is just a click away.

- GPS Tracking for On-Site Employees: For remote or on-site staff, the built-in GPS tracking ensures location verification, improving transparency and accountability.

- Accurate Payroll and Overtime Calculation: Say goodbye to manual payroll errors! TimeChart automatically calculates employee working hours, including overtime, for precise payouts.

- Shift Scheduling Made Easy: Plan, assign, and manage employee shifts effortlessly with TimeChart’s intuitive scheduling tools.

- Task Management for Better Productivity: Organize and assign tasks efficiently to ensure that all team members know their responsibilities and deadlines.

- Simplified Leave Applications: Employees can apply for leave through the app, while managers can approve or deny requests instantly, streamlining the process.

Download TimeChart on All Devices

Whether you're using Android, iOS, or desktop devices, TimeChart is compatible and user-friendly. Experience seamless time and attendance management on any platform.

Contact Us Today

Ready to enhance your workplace efficiency with TimeChart? Visit our website at TimeChart.org or get in touch to learn more about how we can transform your business operations.

Empower your team with TimeChart—the smart solution for time tracking and workforce management!

Contact us on WhatsApp:

Click here to chat with us.

FAQs for UAE VAT Calculator Online

1. What is VAT in the UAE?

VAT (Value Added Tax) is a 5% consumption tax imposed on goods and services in the UAE. Businesses must collect and remit VAT to the Federal Tax Authority (FTA).

2. How does the UAE VAT calculator work?

A UAE VAT calculator helps users calculate VAT amounts by adding 5% VAT to an amount or extracting VAT from a VAT-inclusive price, ensuring accurate tax calculations.

3. Can I use the UAE VAT calculator for free?

Yes, the UAE VAT calculator online is free to use. It provides instant VAT calculations for businesses and individuals in compliance with UAE VAT laws.

4. What VAT rates are available in the UAE VAT calculator?

The standard VAT rate in the UAE is 5%, but the calculator allows users to enter custom VAT rates for zero-rated or exempt transactions.

5. How do I calculate VAT-inclusive and VAT-exclusive prices?

To add VAT, multiply the amount by 1.05.

To remove VAT, divide the total amount by 1.05 to extract the VAT component.

6. Is VAT applicable to all goods and services in the UAE?

No, some items are zero-rated (0%) (e.g., healthcare, education, and exports) or VAT-exempt (e.g., financial services, residential rentals). The UAE VAT calculator supports custom rates.

7. Do freelancers and small businesses need to charge VAT in the UAE?

Yes, if their taxable supplies exceed AED 375,000 annually, they must register for VAT and charge 5% on invoices. Those earning above AED 187,500 can register voluntarily.

8. How can a VAT calculator help businesses in UAE?

A UAE VAT calculator ensures accurate tax compliance, prevents miscalculations, simplifies VAT return filing, and helps in invoicing and financial planning.

9. Can I use the UAE VAT calculator on mobile devices?

Yes, the VAT calculator is mobile-friendly, allowing users to calculate VAT amounts instantly from smartphones, tablets, or desktops.

10. Where can I find official UAE VAT regulations?

For the latest VAT rules and updates, visit the Federal Tax Authority (FTA) website at www.tax.gov.ae.

Other Free Tools

Increase Image Size in KBReduce Image Size in KB

Image DPI Checker - Free Online Tool to Check DPI of Image

Free Online Image DPI Changer - Adjust DPI Instantly

Free CSS Animation Loader - Online CSS Spinner Bar & More

Hyperlink HTML Generator - Online Free

Time Chart - Decimal to Hours and Minutes Calculator

Time Chart - Online Mileage & Fuel Cost calculator

Time Chart Free Work Hour Calculator & Time Card

Time Chart - Convert Military Time